Take advantage of up to £310 in cash and rewards when you switch to one of our Spend & Save bank accounts.

£100 welcome bonus

- Open a Spend & Save account and complete a full switch

- Log into the TSB Mobile Banking App

- Make at least 5 payments using the debit card on your new account

- If you do this before 19 July 2025, we’ll pay you £100 between 2 and 16 August 2025

Up to £90 in cashback

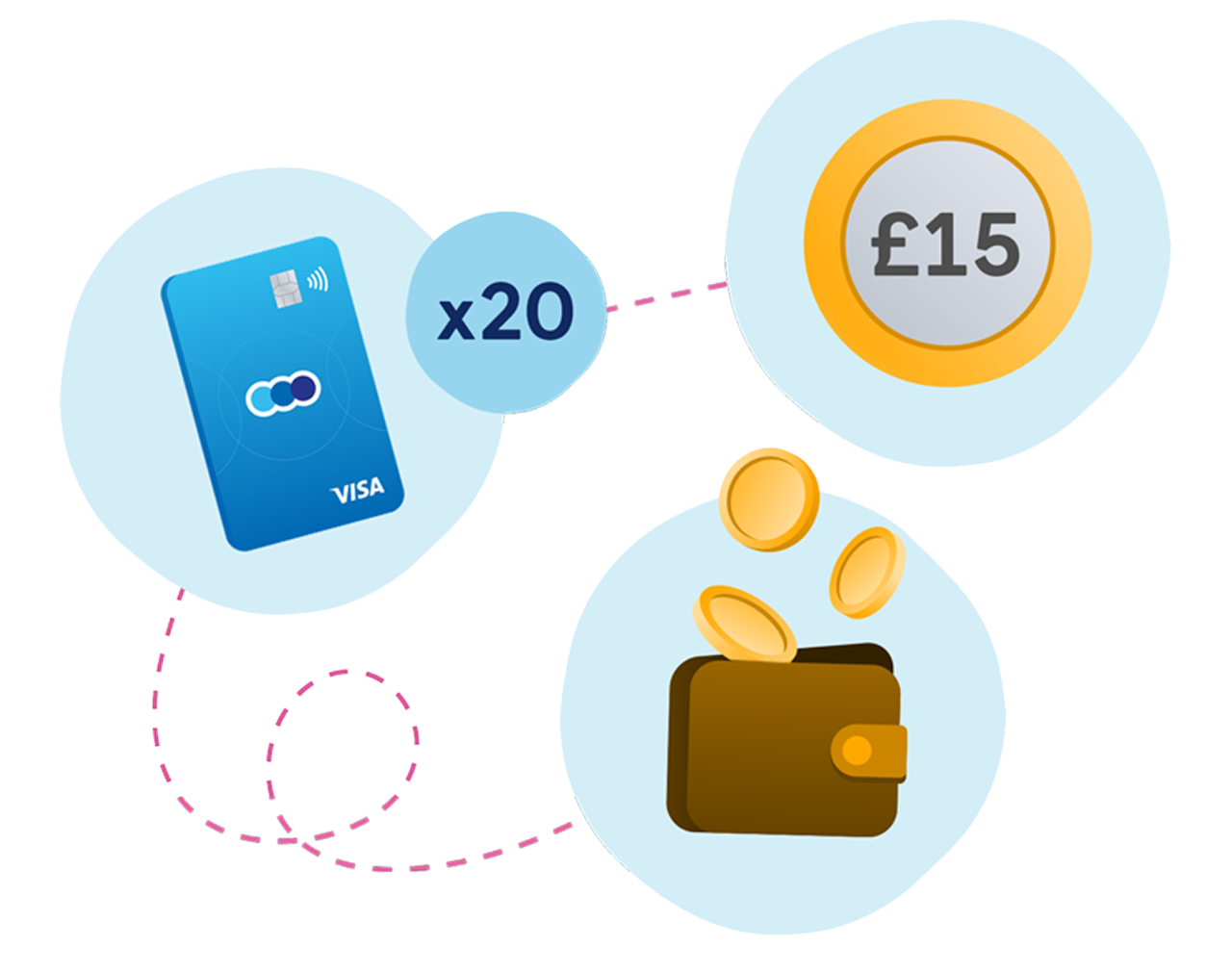

- Earn £15 cashback each month for up to 6 months - that’s triple the amount of cashback we normally offer!

- To qualify for cashback, you’ll need to make 20 or more debit card payments in a calendar month. Pending payments don't count. See how cashback works

- Cashback will be paid into your account the next calendar month

Choose your reward

To choose your reward in January 2026, complete all the steps for the £100 welcome bonus and make 20 or more debit card payments in December 2025.

£120 towards your next hotel stay

Enjoy a £120 voucher that you can use for a hotel stay abroad or a staycation in the UK. T&Cs and exclusions apply.

Access to activity tickets for 12 months

Get tickets for attractions and venues all across the UK, from watersports in Cornwall to museums in the Scottish Highlands. T&Cs and exclusions apply.

Please download and read the full Switch & Stay Terms and Conditions before applying

Step 1:

Open a bank account

- Apply online or download the app to apply

- Start using your account straight away

Step 2:

Complete the online form

- Have your new TSB and old account details handy

- You can find it in ‘Products’ in your TSB app or here

Step 3:

Submit the form

- We’ll complete your switch in 7 working days. Guaranteed

- In the meantime you can still use your old account

Spend & Save

This account offers £5 cashback for six months and smart savings features like Save the Pennies and Savings Pots, plus discounts from big brands with My TSB Rewards.

No monthly fee

Spend & Save Plus

This account offers a £100 interest-free arranged overdraft subject to eligibility, no transaction fees from TSB when you’re abroad, and discounts from big brands with My TSB Rewards. You could even earn cashback.

£3 monthly fee

Start your switch

To switch your current account, you’ll need:

Your new TSB bank sort code and account number

Your old bank sort code and account number

Your old debit card number (if applicable)

Start your switch

Check if you’re eligible for the latest switcher offer

If you’ve received a TSB switching offer since October 2022, you won’t be eligible for this offer.

We use Docusign for this kind of request. Docusign will pass the information you provide to us in a secure manner and won’t process it in any other way. Information on how we use your data can be found in our Data Privacy Notice.

Any questions?

Important information

To read more about our lending commitments to you, please click here to read the leaflet.

*AER (variable) means Annual Equivalent Rate. AER (variable) illustrates what your interest rate would be if interest was paid and compounded each year. Gross rate is the contractual rate of interest payable before the deduction of income tax.