Sorry, we are only accepting business current account applications from existing customers at this time.

Why choose a Business Plus account?

Our business bank account

Business Plus

No frills, straightforward money

- 30 months free day-to-day banking

So long as you keep your account within agreed limits and don’t go overdrawn without arranging it first - Add a Business Debit Card to your account for a quick and easy way to pay for goods and services.

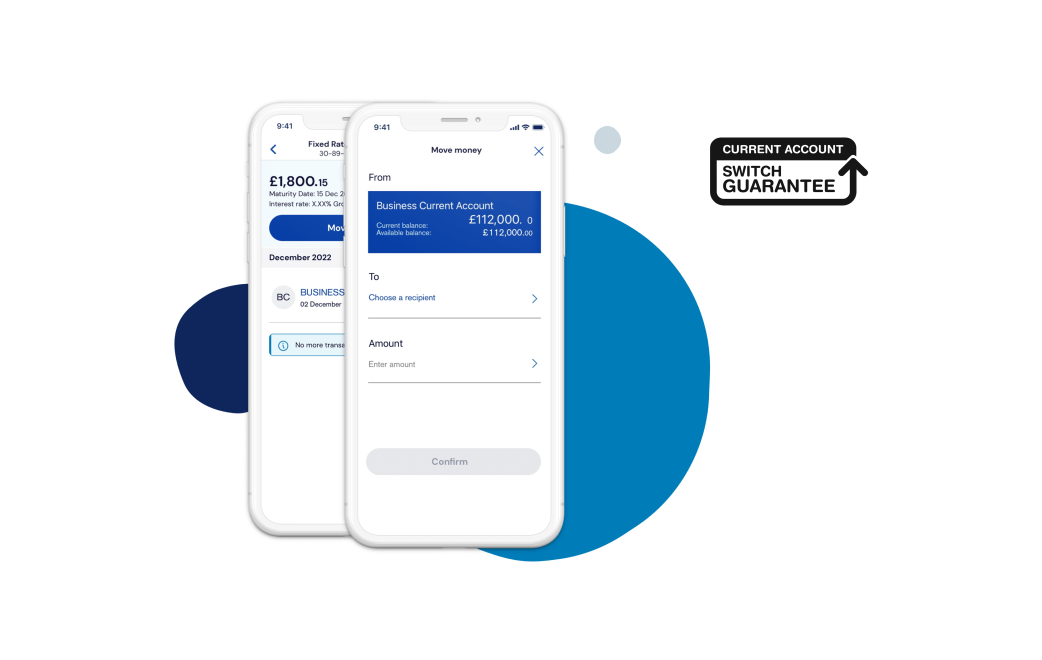

- Switch your business account to us, and our dedicated team will take care of everything.

- Deposit cash and cheques at Post Office branches or our network of TSB branches.

- Receive account updates via text alerts. Find out how.

Costs and charges

| During first 30 months | After 30 months | |

|---|---|---|

| Monthly fee | £0 per month | £5 per month |

| Business debit card transactions, including cash withdrawals | £0 | £0 |

| Cheques - Per cheque paid in or out. | £0 per cheque | 70p per cheque |

| Cash - Per £100 paid in or out, or exchanged. | £0 | 70p |

| Transfer between TSB accounts in your name | £0 | £0 |

| Electronic funds transfer ‘CHAPS’ payment | £30 | £30 |

Further fees and charges for other services can be found in your Business Banking Charges Guide.

Unarranged Overdrafts charges and Unpaid item fees

Unarranged Overdrafts

If you ask us to make a payment when there’s not enough money in your account (or you don’t have enough Arranged Overdraft left) we may decide to make the payment by lending you money using an unarranged overdraft. If we do this, interest and fees apply as set out in this table:

| Amount borrowed using an unarranged overdraft | Interest | Daily fee |

|---|---|---|

| Up to £50 | No interest | No fee |

| £50 up to £200 | Annual interest rate of 19.9% per annum on the full amount borrowed using an unarranged overdraft | No fee |

| Over £200 | Annual interest rate of 19.9% per annum on the full amount borrowed using an unarranged overdraft | £1 a day Maximum 10 fees in any monthly charging cycle |

Unpaid item fee

If we return a cheque unpaid, or there’s not enough money in your account (or you don’t have enough Arranged Overdraft left) to pay a standing order or a UK Sterling Direct Debit, we’ll charge you an unpaid item fee as follows:

| Value of item returned unpaid | Fee |

|---|---|

| £20 and under | No fee |

| Over £20 | £3 for each item that’s returned unpaid Maximum 3 fees a day |

Good to know

We calculate interest and fees daily based on the amount you borrow at close of business on that day. We’ll add the unarranged interest and fees, and unpaid item fees, to your account monthly in one lump sum.

Remember you’ve got until 2.30pm (or up to midnight for standing orders) on the day a payment is due to pay enough money into your account to make sure the payment is made, and avoid paying interest and fees. See section 6 of the Business Banking Current Account Terms and Conditions for more information

Further fees and charges for other services can be found in your Business Banking Charges Guide.

Sorry, we are only accepting business current account applications from existing customers at this time.

If you don’t already have an account with TSB, we won’t be able to accept your application for a business current account.

We will update our website as soon as we are able to open accounts for new customers. Please check back here for updates.

Supporting access to cash

We partner with LINK and Cash Access UK to ensure our customers can easily access their cash.

Find the best way to withdraw cash

Use LINK's cash locator to find the best way to take cash out in your area.

Need better access in your community?

Find out about LINK and how they can improve access to cash in your community.

Business Banking FAQs

If you’re a sole trader or a business with a single director, applying for a Business Bank account typically takes about 30 minutes. After you’ve applied, businesses can usually expect to have their account opened in 5 working days. However, if your business structure is more complex, we might need some more information from you. We will be in touch within 5 working days to let you know if we need anything else.

If you're self-employed, you might wonder if a personal bank account will suffice for your business. Technically, as a sole trader or member of a partnership, you could use a personal bank account. However, at TSB — like many other top banks — we mandate that all businesses, regardless of their type, use a Business Current Account. Simply put, using a personal account for business is not allowed at TSB; you'd need a business account.

Absolutely, business bank accounts, whether current or savings, are covered by the FSCS up to £120,000. However, it varies based on your business structure and personal banking:

- Limited Companies & LLPs: Since they're separate legal entities, you can claim up to £120,000 for the business AND another £120,000 for a personal account

- Sole Traders: They can only claim a total of £120,000, not separate amounts for personal and business accounts

- Joint Business Accounts: If you're partners in a business with a joint account, you're collectively entitled to just one claim of £120,000. In short, yes, business accounts are protected, but the specifics depend on FSCS regulations

To open a Business Bank Account online, you need to be at least 18 years old and live in the UK. Also, make sure your business is registered within the UK.

To set up a business account, you'll need a mix of personal and business documents. Here's a checklist for you:

Personal:

- Proof of your home address

- An ID for verification

- If it's a partnership, your partnership agreement and details about each partner

For Your Business:

- A note of your turnover

- Description or nature of your business

- Proof of your business name

- Evidence of your business address

Gather these up, and you'll be all set!

Considering a TSB business bank account? Here are some great benefits to keep in mind:

- Free Banking for 30 Months: Enjoy daily operations with zero extra costs for over 2 years!

- Access Anytime, Anywhere: With our Business Banking App and online banking, you're always in control, 24/7

- No Fees on Withdrawals: Use any ATM or make debit card transactions without any fees. (Do remember, there are some limits.)

- Payment Solutions: Grab a free Square-reader, enjoy zero fees on up to £5,000 of sales, or get 30% off a Square Terminal for easy in-store or mobile card payments

- Expert Support: Unlock 12 months of free access to Enterprise Nation for tailored advice from industry experts

With these benefits, your business banking becomes easier and more efficient!

Regardless of your business type, TSB offers a consistent Business Current Account (BCA) with the same attractive introductory deals. This applies whether you're opening a new account or switching your existing one over to us.

To open your account, we may need to verify your identity and some details about your business. All business accounts will need to provide proof of business address, an explanation of what your business does, your expected or current turnover (if this is an existing business) and the key people involved in the business.

Different business entities may require additional information. To support you in applying for a TSB business account, you can find a guide to what we need at UK Finance, the UK’s leading trade association for financial services.

Anything we missed? Find it here

FCA - Service Quality Indicators

The Financial Conduct Authority requires us to publish the following information about our Business Current Accounts.

Text alerts

Our free text alerts service delivers account updates direct to your mobile phone as text messages. Each text gives you your balance and up to your last six recent transactions.

Business Internet Banking

Registering for Business Internet Banking is the quick and secure way to manage your business’ finances 24/7.