Sorry, we are only accepting business current account applications from existing customers at this time.

Why choose a Business Plus account?

Our business bank account

Business Plus

No frills, straightforward money

- 30 months free day-to-day banking

So long as you keep your account within agreed limits and don’t go overdrawn without arranging it first - Add a Business Debit Card to your account for a quick and easy way to pay for goods and services.

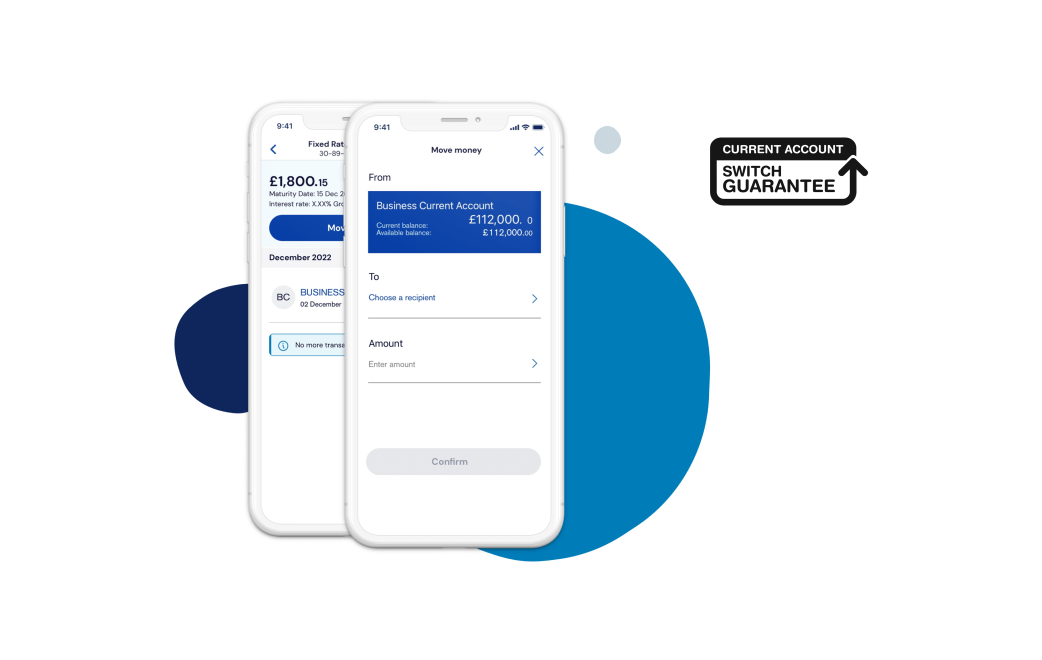

- Switch your business account to us, and our dedicated team will take care of everything.

- Deposit cash and cheques at Post Office branches or our network of TSB branches.

- Receive account updates via text alerts. Find out how.

Costs and charges

| During first 30 months | After 30 months | |

|---|---|---|

| Monthly fee | £0 per month | £5 per month |

| Business debit card transactions, including cash withdrawals | £0 | £0 |

| Cheques - Per cheque paid in or out. | £0 per cheque | 70p per cheque |

| Cash - Per £100 paid in or out, or exchanged. | £0 | 70p |

| Transfer between TSB accounts in your name | £0 | £0 |

| Electronic funds transfer ‘CHAPS’ payment | £30 | £30 |

Further fees and charges for other services can be found in your Business Banking Charges Guide.

Unarranged Overdrafts charges and Unpaid item fees

Ready to apply for a Business bank account?

It’s quick and easy to apply online. We’ll start processing your application as soon as we have all the completed documentation. If we need anything else to get you set up, then we’ll let you know. We will be in touch within 5 working days.

To open a Business Current Account, you need to be an existing active TSB business or personal customer.

Sorry, we are only accepting business current account applications from existing customers at this time.

If you don’t already have an account with TSB, we won’t be able to accept your application for a business current account. If you submitted an application before 20th September, it will be progressed and we will be in touch.

We will update our website as soon as we are able to open accounts for new customers. Please check back here for updates.

Supporting access to cash

We partner with LINK and Cash Access UK to ensure our customers can easily access their cash.

Find the best way to withdraw cash

Use LINK's cash locator(opens in a new tab) to find the best way to take cash out in your area.

Need better access in your community?

Find out about LINK and how they can improve access to cash in your community.

Business Banking FAQs

Anything we missed? Find it here

FCA - Service Quality Indicators

The Financial Conduct Authority requires us to publish the following information about our Business Current Accounts.

Text alerts

Our free text alerts service delivers account updates direct to your mobile phone as text messages. Each text gives you your balance and up to your last six recent transactions.

Business Internet Banking

Registering for Business Internet Banking is the quick and secure way to manage your business’ finances 24/7.