After uni, you might want some time to figure out what’s next.

Our graduate account helps you go from learning to earning.

Convenient banking options

Graduate account arranged overdraft

Put your savings on autopilot

Eligiblity

Apply online

Apply for a Graduate account online in as little as 10 minutes

If accepted, you can then apply for an overdraft - you’ll need to be 18 or over and a UK resident to apply

You'll need your passport or full UK/EU driving licence - not provisional - to confirm your identity

You’ll need a mobile phone or tablet that can scan a QR code and take a picture for our ID check

Or in branch

If you’d rather open a Graduate account face to face, then visit us in branch

You can book an appointment for a time that works for you

Internet Banking

The quick and easy way to control your money. Pay bills, check balances, transfer money between accounts, set up and cancel standing orders, view and cancel Direct Debits and more.

Find out more and get started with Internet Banking

Mobile Banking

Make it easier to manage your money on the go. It means you can do your banking on the move from most internet-enabled mobile devices - either using our app or via your mobile device's browser.

Find out more and get started with Mobile Banking

Telephone Banking

You can call our Telephone Banking service on 03459 758 758.

Our automated service is open 24/7.

Use our quick automated service to:

Check your balance and recent transactions

Pay your bills

Transfer money

Check your Direct Debits or Standing Orders

And you can speak to one of our advisers if you have a more complex query between 8am – 8pm Monday to Sunday.

Find out more about Telephone Banking

These services are available if you are over 16.

Your TSB Visa debit card is an amazing piece of plastic. Accepted in millions of places and cash machines worldwide, it's incredibly convenient. It's just as safe to use abroad as at home, so it's a simple alternative to carrying cash.

An interest-free Arranged Overdraft of up to £2,000 in your first three years after graduation.

Overdrafts are subject to application and approval and are repayable on demand.

You can see full details about your overdraft and get an estimate of the costs of using this with our overdraft calculator.

If your account goes over its limit, our Grace Period means that you have until 10pm (UK Time) to pay in enough money to avoid any Overdraft interest you may incur that day.

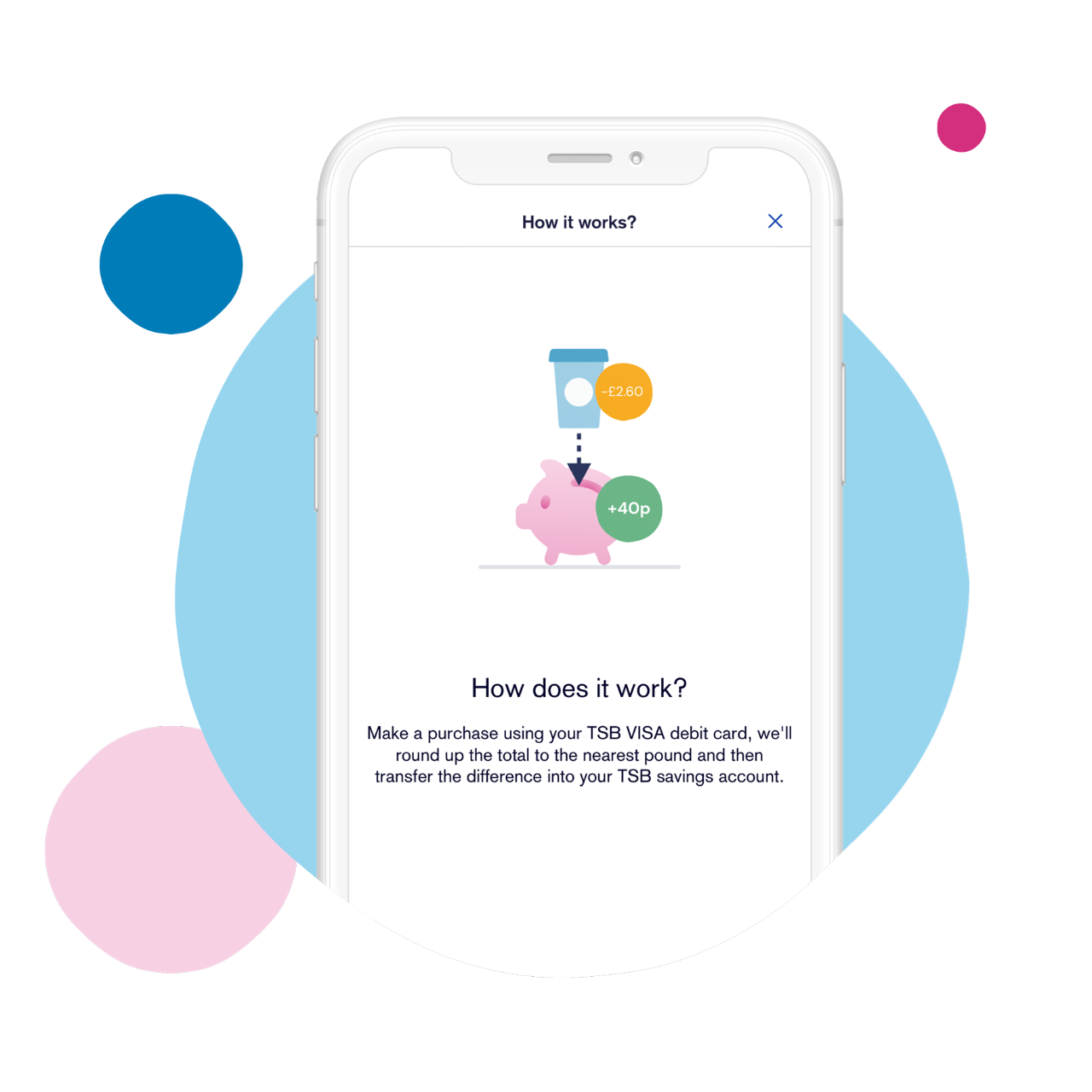

This is a simple everyday way to save for the things you want. Add Save the Pennies on to your account and every debit card payment you make is rounded up to the nearest pound. All those spare pennies go straight into your Savings Pot or any other eligible TSB savings account you’ve set up. So even when you’re spending, you’re putting a little bit aside too.

You can set this up easily on our mobile app, Internet Banking or in branch.

There may be lots of different reasons you might need to bank with us differently, either in the short term, or on a continuing basis. It could be because of your physical or mental wellbeing, or because of a life event you’ve experienced. Whatever the reason, we are committed to tailoring our support to your personal needs.

If you choose to tell us about your individual support needs, we will take the time to understand your circumstances and work with you to make sure you have the support you need when banking with TSB. We can add a Support Indicator to your account, which means whenever you talk to us, we'll be aware that you may need tailored support.

When you have had your Graduate account for three years, we’ll move you to a Spend & Save account. We’ll write to you two months before we do this.

Important information

Account Opening is subject to our assessment of your circumstances. You must be 18 or over and a UK resident to apply.

Overdrafts are subject to application and approval and are repayable on demand.

Text alerts are free but your mobile operator may charge for some services. Please check with them.

We don’t charge for your use of Mobile Banking but your mobile operator may charge for some services, please check with them. Mobile Banking is available on most internet enabled mobile devices. Services may be affected by phone signal and functionality. You must be registered for Internet Banking. Terms and conditions apply.

APR definition: A good way to compare the cost of our overdraft with other overdrafts or other ways of borrowing is to look at the APR. The APR shows the cost of borrowing for a year.

Apple, the Apple logo, Apple Pay, Apple Watch and iPhone are trademarks of Apple Inc. registered in the US and other countries.

Google Pay is a trademark of Google LLC. Android, Google Pay, and the Google Logo are trademarks of Google LLC.

Samsung and Samsung Pay are trademarks or registered trademarks of Samsung Co. Ltd.