Report suspected fraud

Find the fastest way to report your fraud on our ‘How to report fraud’ page

How to cancel your card

You can cancel your card in the TSB Mobile Banking app or use one of the other options here.

Unsure about a transaction?

To help you identify a transaction you don’t recognise follow this guide

We’re proud to offer more fraud protection than any other bank.

On 14 April 2019 we launched our fraud refund guarantee. This is a first in UK banking and it goes further to cover TSB customers against fraud than anything that has come before it. We’re proud to say we refunded 91% of stolen money to fraud victims, which is officially the highest of any UK bank*.

*Source: Authorised push payment (APP) fraud performance report, October 2023.

You're even covered against honest mistakes.

We believe that no TSB customer should have to pay for being tricked by a scam on their TSB account. Whether you accidentally click on something you shouldn't, or share some sensitive information without thinking, we’ll refund you under the terms of our fraud refund guarantee.

When we won’t refund you.

There are a few scenarios where you wouldn’t be covered by our Fraud Refund Guarantee. For details see Are there any times the guarantee doesn’t apply? below.

Prevent. Protect. Pursue.

Our Fraud Prevention Centre is full of advice about fraud and we’re setting up workshops across the UK, so our customers can stay one step ahead and prevent fraud.

Protecting customers with our Fraud Refund Guarantee is just part of our commitment to fight fraud in Britain.

And we help the police to pursue criminals, giving them the information they need to hunt down fraudsters and bring them to justice.

To find out more about our Fraud Refund Guarantee have a look at our helpful info below.

Helpful Information

We believe that customers who are innocent victims of fraud shouldn’t have to fight for a refund. So, from 14 April 2019, we will refund customers who are clearly the innocent victim of fraud on their TSB account.

- TSB customers will need to contact us to report fraud exactly as they do today, by calling the number on the back of their card. Alternatively, customers can call 0800 023 4113 (credit and debit card related fraud) or 0800 096 8669 (Internet, mobile, or telephony related fraud).

- We will quickly investigate the fraud claim, to make sure that we understand how it’s happened – so that we can give you safety advice to make sure you’re not affected by fraud again. We may also need to help you to reset your login details or other account information.

- Your refund will be paid back into your account as quickly as possible.

- As you’d expect, we will not repay losses where customers are involved in committing the fraud.

- Customers will not be refunded where they have abused the guarantee, for example by deliberately ignoring account safety information and/or making repeated claims under the guarantee.

- The guarantee doesn’t cover purchase disputes, where you pay for something with your TSB account and the goods or services don’t meet your expectations. This could be if the item arrives differently to how it was described But, if you feel you’ve been misled by the seller, you may be able to claim under the chargeback rules or the Consumer Credit Act, if you used a debit card or credit card.

- The guarantee doesn’t apply if the fraud losses happened before Sunday 14 April 2019.

- The guarantee covers authorised and unauthorised transactions for claims meeting the criteria; for authorised transactions the guarantee is limited to £1million per claim.

- The TSB Fraud Refund Guarantee doesn’t change how we’ll investigate claims. We’ll still look for what happened and how it happened, so we can give you advice to protect you from future fraud.

- We know how important it is to pursue fraudsters. And we use our investigations to gather the evidence needed to prosecute the criminals behind fraud attacks.

- At the moment, there are certain times where banks are legally obliged to refund customers, however even these have loopholes. Our guarantee covers customers who are clearly innocent victims of fraud on their TSB account.

- TSB is the first bank in the UK to offer anything like this level of cover to customers.

- The guarantee only applies to fraud losses that happened on or after Sunday 14 April 2019.

- If you got a decision from a claim that you made before Sunday 14 April 2019, this decision cannot be overturned unless there is new evidence that would have made us reach a different decision at the time – the guarantee doesn’t apply to fraud that happened before 14 April 2019.

If you want to see how we protect you from fraud and how to protect yourself, explore our Fraud Prevention Centre.

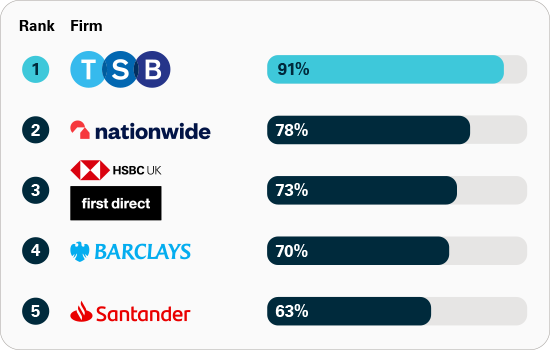

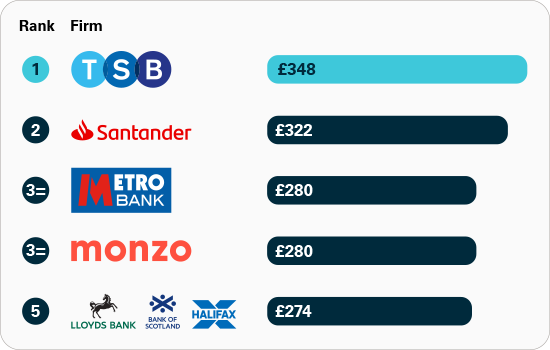

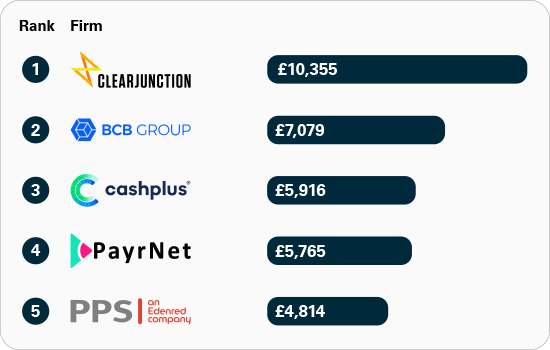

Authorised push payment (APP) fraud rankings in 2022

Authorised push payment (APP) fraud happens when someone is tricked into transferring money to a fraudster’s bank account. These charts use data given to the Payment Systems Regulator (PSR) by major banking groups in the UK, in 2022.

You can read the full report by visiting www.psr.org.uk/app-fraud-data

Share of APP fraud refunded

This data was provided by major UK banks in response to a request from the PSR and shows the proportion of total APP fraud losses that were reimbursed, out of 14 firms. Higher figure is better.

APP fraud sent per £million transactions

This data was provided by major UK banks in response to a request from the PSR and shows the amount of APP fraud sent per million pounds of transactions, out of 14 firms. Lower figure is better.

APP fraud received per £million transactions: smaller UK banks and payment firms

This data shows the amount of APP fraud received per million pounds of transactions, out of 20 firms. Lower figure is better.

APP fraud received per £million transactions: major UK banks and building societies

This data shows the amount of APP fraud received per million pounds of transactions, out of 20 firms. Lower figure is better.